This App is free and works with the Paid version of Budget Challenge ($20/student).

Overview:

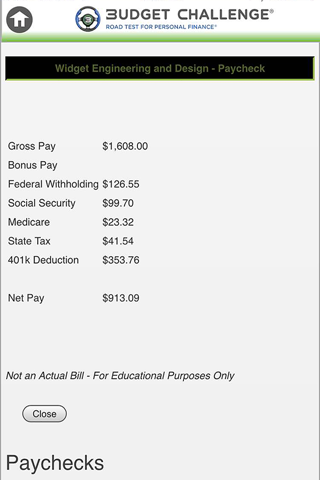

Budget Challenge® is an award-winning and patented program that actually SHOWS young people how to manage money in a real life setting. We use a Learning-By-Doing approach to put students in the driver’s seat in our Road Test for Personal Finance®. Our simulations are 9-16 weeks in duration and students receive paychecks and bills in real time and are challenged to pay their bills and save money for retirement in a 401k. Unlike other simulations, Budget Challenge is also a competition that scores and ranks students based on how well they save, answer weekly quizzes, and manage their financial responsibilities (pay bills). Students can compete with other students in their class and classes can compete with other classes based on class average to make learning engaging and fun.

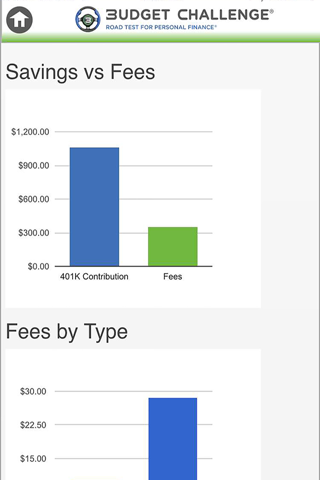

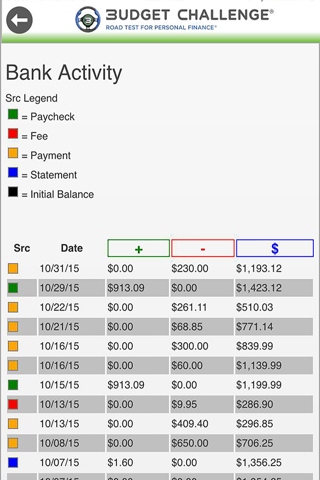

The simulation does not use real money, but is extremely realistic including features such as online bill pay, direct deposit, email bill alerts, 401k paycheck deductions and more. Budget Challenge also includes many of the complicated banking and credit card fees that plague young people in the real world, so students can learn the ropes and make their costly ‘rookie’ mistakes in the safety of the classroom.

Budget Challenge aims to make students Real World Ready by focusing on Behaviors, Knowledge, and Skills. Our program aligns with NCEE and Jump$tart national standards and goes well beyond teaching vocabulary and financial concepts by putting these topics into action with real consequences. This patented product delivers unparalleled results that really matter for students entering the real world. The statistics below were from a study of over 25,000 students and were published on Time.com:

* 92% said learning about money management was very important and 80% wanted to learn more

* 92% said they were more likely to check their account balance before writing a check

* 89% said they were more confident and 91% said they were more aware of money pitfalls and mistakes

* 87% said they were better able to avoid bank and credit card fees

* 84% said they were better able to understand fine print and 79% said they were better able to compare financial products

* 78% said they learned money management methods that worked best for them

* 53% said they were rethinking their college major or career choice with an eye toward higher pay

While most of the core functionality of the website is contained in this app, there are limitations of small screens, so some content has been abridged or removed from the app. For first time users, we recommend playing the simulation for a week or two on a PC/Mac before using the app exclusively.

Achievements:

2015 EIFLE Award Winner: Education Program of the Year - Money Management

Patent Nos. 8,444,418 and 8,740,617

Presenter at National Conferences: NCEE (National Council for Economic Education) and NCSS (National Council for Social Studies)